What’s Driving Rum Sales in 2021

A number of consumer trends have propelled rum sales this year.

“Vacation in a glass” is how Todd Thrasher describes the rum and cocktails he serves at his bar Tiki TNT in Washington, D.C.’s District Wharf. Thrasher is heavily invested in rum: not only does he stock nearly 250 different rums behind the bar but he also produces and sells his four expressions of Thrasher’s Rum brand at the urban waterfront Potomac Distilling Co.

The rum category as a whole benefits from the feeling of escapism. And after a year of this pandemic, just about everyone needs a vacation, or at least a good cocktail, whether at their favorite bar or restaurant, as takeout or delivery or as retail at-home mixology.

Mixability is one of rum’s many strong points.

“Rum is the most flexible and food friendly spirit in my opinion,” says Aniece Meinhold, co-owner of Phuc Yea, a New-Vietnamese cuisine restaurant in Downtown Miami. She stocks a dozen rums behind the bar, but mainly relies on Bacardi 8, Havana Club Blanco and Anejo, and Santa Teresa 1796 for signature rum-based cocktails.

Top Shelf Growth

Rum’s greatest strength is its versatility and diversity, with expressions ranging from white rum and black rum, to dark rum, overproof rum, spiced and flavored rums and rhum agricole. Popular spiced and flavored rums are driving category growth, as are top-shelf super-premium aged rums.

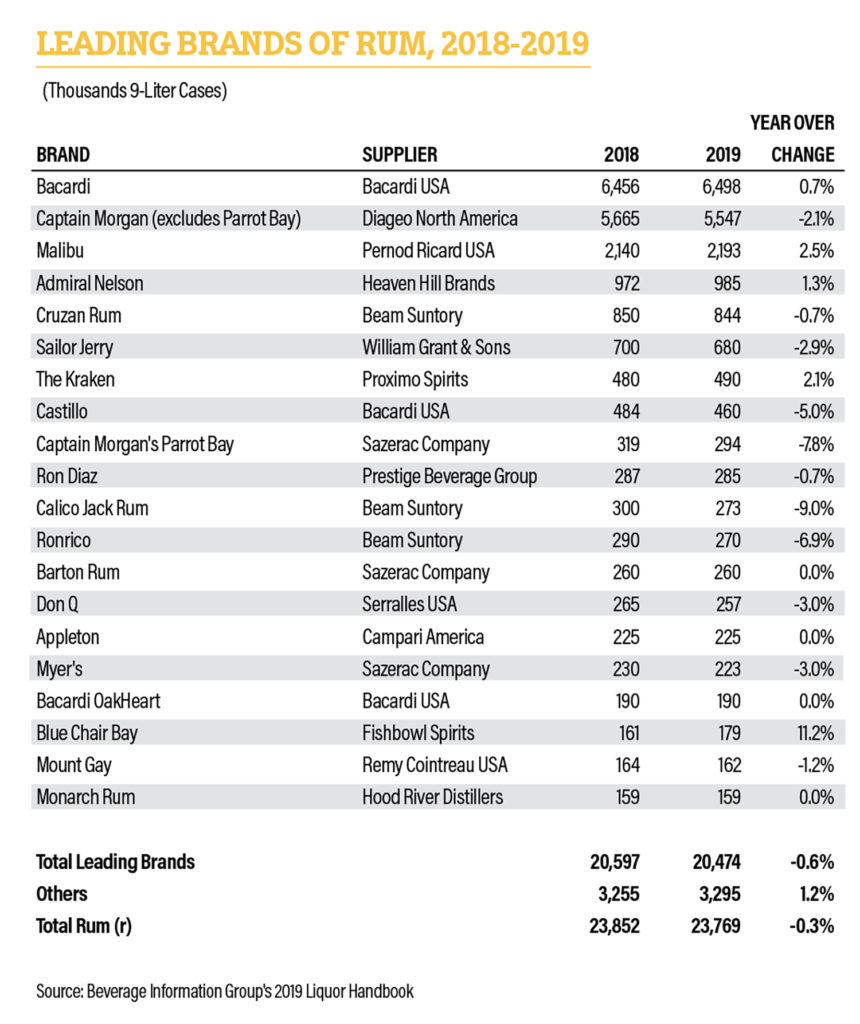

Rum category revenue increased 5.9% in 2020, according to the Distilled Spirits Council of the U.S., with most of that growth from High-End Premium (8.7%) and Premium (7.6%) and Super-Premium (3.7%).

“The success story in rum continues to be premium, with all category growth and optimism coming from super-premium and above segments,” says Alex Fellows, senior brand manager for Diplomatico Rum.

“Our rum portfolio has grown immensely over the years,” says Rebecca Monday, general manager/beverage manager at VASO, a Spanish tapas-style restaurant in Dublin, OH. “I’m personally a huge Tiki lover and never miss an opportunity to showcase a Tiki cocktail on each menu as well as stock an assortment of 20-30 different rums behind the bar.”

“The rum category is still benefiting from a strong retail performance in the U.S. and definitely experiencing premiumization,” says Guillaume Lamy, vice president at Maison Ferrand, The Americas. But the Covid restrictions in restaurants and bars have hurt sales. The company’s Plantation Rum brand was growing at 26% as of March 2020, but ended the year at 15%, due to a drop in on-premise business.

Sales of Ron Abuelo in the U.S. were healthy in 2020, says Daniel Fábrega, vice president, export at Varela Hermanos S.A. “Ron Abuelo is found primarily in the off-premise; this has given us an advantage over many of our competitors as consumers’ buying habits drastically transitioned this past year toward retail because of the pandemic.”

Trading Up

Premiumization is driving growth, says Chris Rigby, managing director of North America for Don Papa Rum, pointing to the strength of the super-premium niche. “There is now an established trend of consumers who are trading up to aged rums.”

“The rum category in the U.S. continues to show signs of revitalization, with growth particularly in the premium category,” despite the economic uncertainties brought about by the pandemic,” says Malcolm Gosling Jr. The Goslings brand has benefited from the premiumization trend, and is growing healthily, he adds.

“We’ve found that people are trading up and trying new things, mostly as a treat to themselves,” says Raphaël Grisoni, managing director for the Barbados-based Mount Gay, established in 1703. “There is more time to spend exploring, and people are apt to learn about a brand, diving deep into the history and culture of a spirit.”

Katherine Foley, brand manager for Zaya Rum, agrees. “Rums on the middle-top shelves are currently trending and driving overall sales, as people are trading up to elevate their at-home cocktail experience.”

The Whiskey Connection

Many in the field, both bartenders and producers alike, believe that barrel-aged dark rums should have crossover appeal for whiskey drinkers. Some rums are aged in repurposed bourbon or other whiskey barrels to further cement that connection.

“Rum has complexity that could appeal to bourbon drinkers,” says Cesar Olivio, co-owner Reunion Ktchn Bar in Miami. To show off that complexity, Olivio makes an Old Fashioned substituting aged rum for whiskey, “which might catch a bourbon lover’s eye.”

Similarly, Olivio offers an educational flight of three 1-oz. pours of different Diplomatico Rums. Reunion Ktchn Bar stocks 10 different rums.

Much of the interest in aged rums is fueled by non-rum drinkers beginning to explore quality rums, says Rigby. “Drinkers of bourbon, for instance, are attracted by the vanilla and caramel notes of the sweeter rums. Maybe it is no coincidence that Don Papa Rum is aged in bourbon barrels.”

As part of its Master Blender Collection, which experiments with different cask finishes, Mount Gay released XO: The Peat Smoke Edition in 2018, which appeals to Scotch fans.

Ron Abuelo has launched XII Años Two Oaks to the U.S. market. “This is an innovative aged rum that Luis J. Varela Jr. conceived as a bridge for those who enjoy whiskey, especially bourbon, and rum,” says Fabrega.

Flavor, Spice & Everything Nice

Spiced and flavored rums are, of course, a major component of the category. Spiced rum is a perennial favorite. Currently the “it” flavor seems to be coconut, with a strong showing by pineapple. One advantage of spiced and flavored rums is that they make it simple for consumers to enjoy a cocktail experience at home, with just the addition of seltzer or soda as a mixer.

Of course, bartenders make good use of flavored and spiced rums as well. At VASO, Monday employs Plantation Pineapple Rum for mixing up popular mini-Daiquiris.

One of the best-selling rum drinks at Reunion Ktchn Bar is Coconut Pistachio Mai Tai, which is made using Big Five Coconut Rum, Clement rum, lime juice, house-made pistachio orgeat and pineapple, garnished with a grilled slice of pineapple and served in pineapple-shaped glass. “We sell a lot of that cocktail,” which is priced at $14, says owner Olivio.

“The rums we use the most often would definitely have to be Bacardi, Cruzan rum and Cruzan aged dark rum,” says Landen Thompson, food and beverage supervisor at Margaritaville Resort Orlando. Especially flavored variations, such as Bacardi Coconut, Dragon Berry and Raspberry; and Cruzan Limon Cruzan, Coconut, Mango and Hurricane Proof. “We find these flavors add a diverse range of options when creating unique cocktails and transport guests to the tropical island vibes that we strive to create,” Thompson says.

Spicing Rum Sales

“Flavored and premium spiced rums continue to drive growth in the category,” says Hannah Venhoff, group product director for Heaven Hill Brands. “Admiral Nelson’s Rum and Blackheart Rum were growing pre-Covid, and have seen momentum propelled forward by the pantry stocking and consumer choice during Covid.”

The brand is narrowing marketing focus to those flavors that work the hardest in the portfolio, which are Admiral Nelson’s Pineapple and Admiral Nelson’s Coconut, says Venhoff. Blackheart will expand the launch of Blackheart Toasted Coconut to more markets this year. Toasted Coconut is the brand’s first line extension, launched in spring 2020. The new expression is 93-proof spiced rum with the addition of fresh coconut and a warm toasted finished.

“To support our flavors and spiced rum, we are bringing back a popular year-round off-premise display featuring a large-scale bobble-head of the Admiral,” says Venhoff, and continuing a point-of-sale campaign, tagged “Make Life Taste Better.” Blackheart Rum will continue the “up to something good” campaign, reinforced by a national media campaign.

“Koloa Kaua’i Cacao Rum expands our flavor expressions with a chocolate-flavored rum,” says Bob Gunter, president/CEO of Hawaii’s Koloa Rum Co. “It incorporates the finest Hawaiian-grown cacao from our neighbors at Lydgate Farms, a fifth generation Kaua’i family farm that is recognized for producing some of the finest chocolates in the world.”

Keeping Top of Mind

New releases and marketing campaigns ramp up consumer interest in rum, and producers have been busy with both.

Zaya introduces two line extensions this year: Zaya Expresión, a blend of aged rums for mixing, and Zaya Alta Fuerza, a spice-forward overproof rum. “The Zaya Ignite your Senses is our overarching brand campaign for the year,” says Brynn Buechler, assistant digital marketing manager. The program includes both digital and trade-oriented efforts, as well as live virtual events, giveaways, and mixology programs.

Koloa recently debuted its Five-Year Aged Koloa Kaua’i Reserve. The third aged rum release for Koloa, it is a single-barrel rum, aged in charred American oak barrels and bottled at cask strength. “The marketing team has developed meaningful partnerships with a group of mixologists and recipe creators that we have coined as our ‘rumbassadors,’” says Gunter.

Plantation is rolling out its Isle of Fiji Signature blend as a line extension of its other Signature blends from Barbados and Jamaica.

The company is also releasing limited allocations of vintage rums, as part of its Bird Collection: Fiji 2005, Jamaica 2003, Barbados 2011, Peru 2006 and Trinidad 2007.

Don Papa’s main focus is expansion into new U.S. markets, says Rigby. April will see the launch of a sherry cask finish from four different casks: Fino, Pedro Ximenez, Palo Cortado and Cream. Besides social media and seasonal photo shoots, Don Papa has a traveling rum bar in a converted horse trailer.

Mount Gay began to reset the brand overall in 2020, says Grisoni, “and due to Covid we are extending our launch period through 2021-2022.” Initially that included new blends for Mount Gay Black Barrel and XO, and a packaging redesign, as well as on- and off-trade activations, consumer events, increased participation in its global sailing program and commitment to sustainability.

Destilería Serrallés, the Puerto Rico-based producer of Don Q, this past fall introduced Don Q Gran Reserva XO, a rebranding of Don Q Gran Añejo rum. This follows the launch of Don Q Reserva 7, a blend of multi-column distilled light rums and single copper column distilled heavy rums, aged for a minimum of seven years in American white oak barrels.

The Ron Abuelo Finish Collection is a trio of double-barreled, aged spirits. Each of these 15-year-old expressions spent their final year finishing in ex-Oloroso sherry, ex-Napoleon Cognac or ex-tawny port casks. “We partnered with RumRatings.com to directly engage with the rum community,” says Larissa Arjona, export marketing manager for Varela Hermanos. One program revolved around the release of XII Años Two Oaks with tastings and a masterclass.

At-home Mixology

With much of the business pivoting toward retail, producers are busier than ever encouraging at-home mixology. For cocktails, white, spiced and flavored rums are the usual components, but aged dark rums can also be mixed as well as sipped, say proponents.

In response to more consumers taking on an at-home bartender role in the past year, Don Papa rolled out initiatives to engage with imbibers at home, Rigby says. “We put out cocktail recipes made with easy-to-find ‘pantry’ ingredients. For example, Breakfast for Dinner uses orange juice, marmalade and vanilla ice cream; Working From Home calls for leftover coffee and cocoa powder. We wanted to make things as easy as possible and offer a bit of comfort during stressful times.”

Zaya Rum recently hosted the brand’s first live virtual event, with demonstrations crafting a Zaya Mai Tai, as well as a Daiquiri. “We spotlighted the versatility of our liquid and showcased how consumers can craft a quality cocktail with three ingredients, as well as complex, yet classic Tiki drinks,” says Foley.

“Mixability is an important component of the rum category, and definitely for the Plantation line,” says Lamy. “Plantation 3 Stars, Original Dark, Stiggins Pineapple and OFTD were made for cocktail programs, and are being promoted as a key ingredient to the consumer for at-home drinks.” Bottles of 3 Stars and Original Dark have a QR code that teaches consumers how to make cocktails at home, with varying levels of difficulty.

“When many consumers think of rum, their minds automatically go to white rum, namely beach cocktails like a Piña Colada. But the category is far more diverse than that,” says Geoff Robinson, global brand ambassador for Santa Teresa 1796. “We’re seeing that consumers are gravitating towards the dark, premium rum category.”

He cites spirit-forward cocktails that express the flavor of the rum, such as a twist on the Negroni called The Right Hand and the Café de Madre, a rum-based cross between a Manhattan and an Espresso Martini.

“Our spiced and flavor rums offer a foundation for sipping on their own, with a simple mixer like Admiral’s Spiced Rum and ginger, or in an easy at-home cocktail,” suggests Venhoff. As examples, she suggests the Non-Cola Cuba Libre, which simply combines Admiral Nelson’s Spiced Rum with lime hard seltzer, the Coconut Colada, a frozen drink that can be easily whizzed up at home with Admiral Nelson’s Coconut Rum, milk and pineapple juice.

Covid has had a crippling effect on the on-trade, says Diplomatico’s Fellows, and “there will be choppy waters before we get to that much happier place.” But he suspects many consumers will want to celebrate by treating themselves to high-quality products and intriguing brands.

“In so many ways, the pandemic has forced us all to refocus on what is important including those little luxuries, daily/weekly rituals and sharing good food and drink with family and friends,” says Santa Teresa’s Robinson. “People are investing more time in moments that matter, whether it is entertaining at home, or safely patronizing local bars and restaurants.”

Thomas Henry Strenk is a Brooklyn-based writer specializing in all things drinkable.

The post What’s Driving Rum Sales in 2021 first appeared on Beverage Dynamics.