Data Driven: Where Tequila Sales Differ

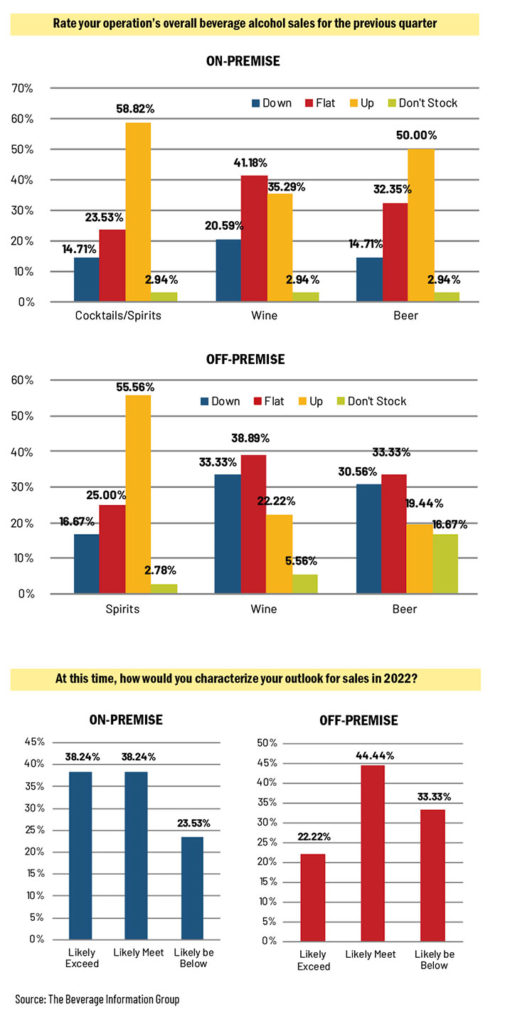

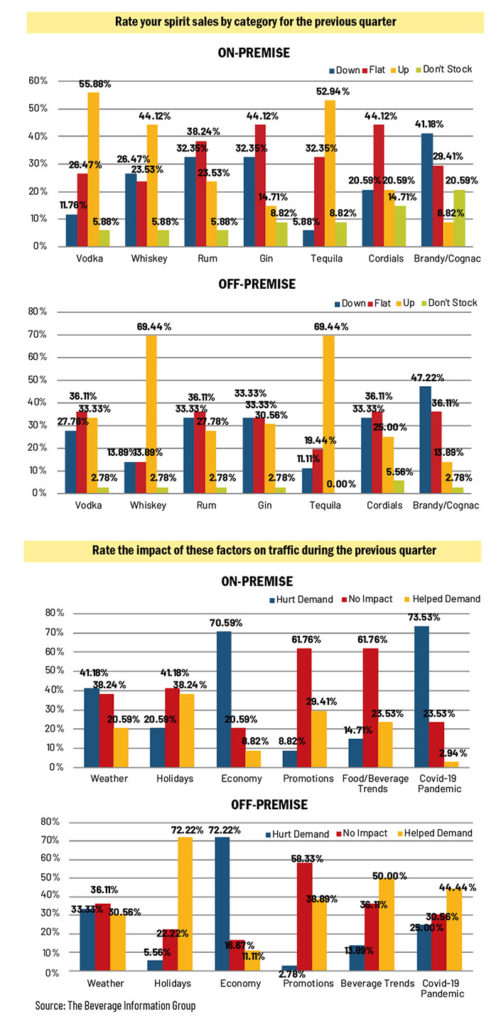

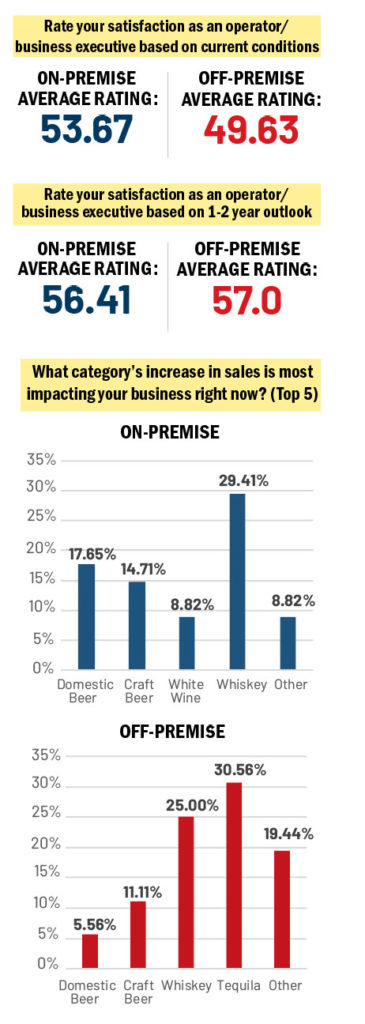

As part of our ongoing tracking of the industry, the Beverage Information Group surveys our readers quarterly, collecting trends/sentiment data from distributors, on-premise and off-premise operators. For our most recent study, conducted in August 2022, whiskey sales have slowed a bit both on and off-premise, though it’s still the dominant category for the bars and restaurants surveyed. And while tequila was the top sales driver for retailers, the agave spirit didn’t even make the top 5 for on-premise respondents in terms of categories having an impact on sales.

Domestic beer and white wine showed significant gains in the on-premise, a likely nod to summer weather. Along the same lines, more off-premise respondents checked the ‘other’ as impacting their business this quarter. Write-in responses to the question revealed an increase in sales ready-to-drink (RTD) beverages was most affecting business for more than 10% of retail participants. But both on- and off-premise operators cited domestic beer’s decline in sales as having the biggest impact on sales.

The on-premise operators remain more satisfied and optimistic based on current conditions than the off-premise respondents. But based on a one- to two-year outlook, business satisfaction levels for both the restaurants and retailers were about the same.

For more information about our beverage reader surveys and for pricing information about adding questions to upcoming surveys, contact Debbie Rittenberg at drittenberg@epgacceleration.com.

Melissa Dowling is editor of Cheers magazine, our on-premise sister publication. Contact her at mdowling@epgmediallc.com, and read her recent piece, Our 2022 Wine Supplier of the Year: The Wine Group.

Feature photo by Dylan Freedom on Unsplash.

The post Data Driven: Where Tequila Sales Differ first appeared on Beverage Dynamics.