6 Spirits Join Our Growth Brands Hall of Fame

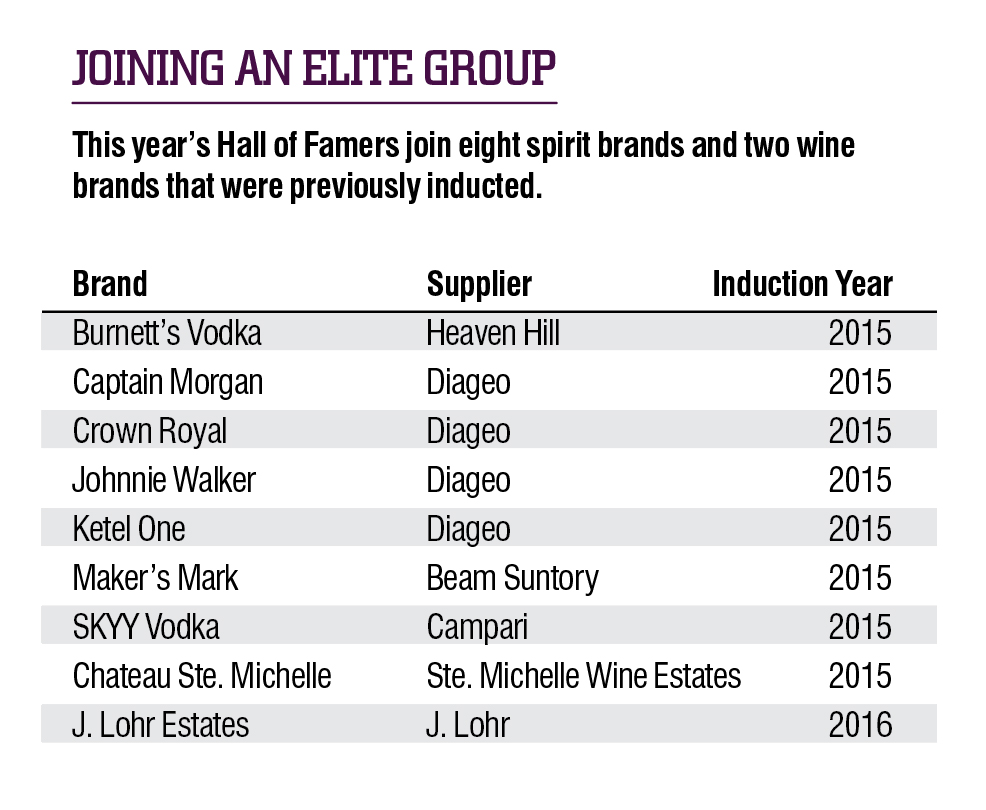

Created in 2015, the Growth Brands Hall of Fame honors sustained growth in the beverage alcohol industry. Wine and spirit brands inducted into the Hall of Fame must have won at least 15 Growth Brands Awards, which have been presented since 1997 by the Beverage Information & Insights Group, an affiliate of Beverage Dynamics Magazine. This year, six spirits qualified for that honor by winning their fifteenth award.

Winners were honored at the Growth Brands Awards reception at the Wine & Spirits Wholesalers of America Convention in Orlando.

The following profiles of each brand highlight what makes it stand out against the competition. These six winners are the best of the best, and we congratulate each of them on their accomplishment. We hope that younger brands, or established brands closing in on their fifteenth win, will aspire to one day join them in the Hall of Fame.

Bombay Sapphire (Bacardi USA)

2016 Sales: 987,000 9-liter cases

Launched in 1987, Bombay Sapphire London Dry Gin is flavored using ten ingredients: almond, lemon peel, liquorice, juniper berries, orris root, angelica, coriander, cassia, cubeb and grains of paradise. Created at the historic distillery in Laverstoke Mill in England, the gin is known around the world for its flat-sided blue bottle. The brand is also known for its partnerships with designers and the creative community.

Launched in 1987, Bombay Sapphire London Dry Gin is flavored using ten ingredients: almond, lemon peel, liquorice, juniper berries, orris root, angelica, coriander, cassia, cubeb and grains of paradise. Created at the historic distillery in Laverstoke Mill in England, the gin is known around the world for its flat-sided blue bottle. The brand is also known for its partnerships with designers and the creative community.

“We’re incredibly proud of the work we’ve done on the Bombay Sapphire Artisan Series, fostering emerging artists as a North American search for the next big name in visual arts,” says VP and Managing Director Tom Swift. “Now entering its eighth year, the series is an international platform for visual artists to showcase their talent.”

Bombay Sapphire has also sponsored the Most Imaginative Bartender competition for more than a decade, which supports emerging mixologists. Like the gin category in general, Bombay Sapphire has grown on-premise in recent years.

“We’re seeing a cocktail renaissance across the country, with continued growth and interest in classic cocktails,” Swift says. “People are not only looking to learn more about gin, but to understand how to use it. Bombay Sapphire has an important role to play in educating and welcoming people into the category.”

Hennessy (Moet Hennessy)

2016 Sales: 3.47m 9-liter cases

Founded in 1765 by Irishman Richard Hennessy, the House of Cognac sells more than 40% of the world’s Cognac today and is an iconic luxury spirits brand. From its grapes grown in the Cognac region to its French Oak barrels made by in-house coopers, the brand retains much of its historic authenticity despite its size.

Founded in 1765 by Irishman Richard Hennessy, the House of Cognac sells more than 40% of the world’s Cognac today and is an iconic luxury spirits brand. From its grapes grown in the Cognac region to its French Oak barrels made by in-house coopers, the brand retains much of its historic authenticity despite its size.

Hennessy’s master blenders have been members of the Fillioux family for eight generations, since Richard Hennessy hired Jean Fillioux as his first master blender in 1786. Today, Yann Fillioux fills that role.

Hennessy first arrived in the U.S. in 1792, which is today its number-one market in the world. Over the years, the brand has added line extensions and limited releases to its growing family of Cognacs, often working in partnership with artists and designers to craft unique bottles, including a number released around the time of the brand’s 250th anniversary in 2015.

Patron (The Patron Spirits Co.)

2016 Sales: 2.47m 9-liter cases

Introduced in 1989, Patron Tequila is a case study in developing a new price point for a category built on value brands. The small-batch spirit is made at Hacienda Patron, with the company boasting that sixty hands go into hand-making each bottle. Patron’s rise has been slow and steady, as it built a market for $40-and-above tequila in the U.S.

Introduced in 1989, Patron Tequila is a case study in developing a new price point for a category built on value brands. The small-batch spirit is made at Hacienda Patron, with the company boasting that sixty hands go into hand-making each bottle. Patron’s rise has been slow and steady, as it built a market for $40-and-above tequila in the U.S.

“Our sustained growth has always rested on having a long view, and not reacting to short-term trends or fads,” says Global CMO for Patron Spirits, Lee Applbaum. “Today we have the skill and leadership to shape the category and the gravity to move smaller brands, but that has come from many years of patient and strategic marketing, focusing on the core values of the brand.”

Patron has always focused on authenticity and its handcrafted product, which appeals to today’s Millennial consumers. It has also released relatively few line extensions, going more than a decade at a time without a new release.

“We don’t introduce many new products, and ensure that those we do have a strategic rationale and will generate profits for all partners in the value chain – from distributors to retailers to bars and restaurants,” Applbaum says. “We believe firmly in earning our way onto the back bar or shelf.”

While Patron has plenty of competition in the high-end of the tequila category today, it stands out as an innovator that led the trend toward higher-priced agave spirits.

“We obviously spent our early years building something from nothing, changing consumer understanding about what authentic tequila really is,” Applbaum says. “Once the category gained mass and inertia, we’ve been able to enjoy the fruits of that early foundational work and have seen an accelerated growth trend – particularly for some of our aged marks and more artisanal products like Roca Patron.”

Remy Martin (Remy Cointreau USA)

2016 Sales: 825,000 9-liter cases

Remy Martin, a young winegrower, began selling Cognac under his name in 1724. Today, it is the only Cognac house that has remained family-owned throughout its history. The company ages its Cognacs for between 10 and 37 years, offering a wide range of products within the portfolio.

Remy Martin, a young winegrower, began selling Cognac under his name in 1724. Today, it is the only Cognac house that has remained family-owned throughout its history. The company ages its Cognacs for between 10 and 37 years, offering a wide range of products within the portfolio.

“We are committed to the core values of investing in community, nature, craftsmanship and embracing the time it takes to cultivate one of the most premium Cognacs year after year,” a representative for the brand says. “We focus on delivering high quality and culturally compelling brand experiences from the shopper journey to the point of purchase.”

Part of Remy Cointreau since 1991, the brand is responsible for a number of “firsts,” including the first female cellar master of a major Cognac house, Pierrette Trichet in 2003. With aging stock often passed from generation to generation, the company is focused on the future, with an eye to the past.

“Remy Martin already understood the magical effects of time; how a company, like a spirit, can develop and grow finer with age,” the rep says. “The eaux-de-vie of Grande and Petite Champagne are particularly rich and delicate, requiring a greater number of years to fully express their true character. They have outstanding aging potential, and because each generation at Remy Martin believes in the future, it now boasts one of the greatest Cognac eaux-de-vie reserves in the world.”

Sauza (Beam Suntory)

2016 Sales: 2.25m 9-liter cases

Casa Sauza, home of Beam Suntory’s Sauza tequila, is one of the oldest tequila distilleries and the first to export tequila outside Mexico. Throughout the brand’s 144-year history, it has weathered economic challenges and adapted to consumer trends. In recent decades, the brand has capitalized on the popularity of the margarita.

Casa Sauza, home of Beam Suntory’s Sauza tequila, is one of the oldest tequila distilleries and the first to export tequila outside Mexico. Throughout the brand’s 144-year history, it has weathered economic challenges and adapted to consumer trends. In recent decades, the brand has capitalized on the popularity of the margarita.

“The margarita has been and remains the number-one cocktail in the U.S. and the preferred cocktail enjoyed among groups,” says VP of Tequila and Innovation Malini Patel. “Mixologists and consumers are becoming more innovative and utilize tequila’s versatility, expanding beyond current recipes as well.”

The brand is currently sold in more than 50 countries, and is available in four variants: Blanco, Extra Gold, Blue Silver and Blue Reposado.

“We recognize the opportunity to capitalize on the growth potential within the tequila category as the consumer market changes,” Patel says. “Sauza is uniquely positioned within the category by offering a portfolio that appeals to a wide variety of consumer preferences and price points.”

Svedka (Constellation Brands)

2016 Sales: 4.34m 9-liter cases

Manufactured in Lidkopen, Sweden since 1998, Svedka vodka is one of the best-selling imported vodkas in the U.S. Acquired by Constellation Brands in 2012, Svedka is known for its embrace of new technology to communicate with consumers and for its wide-ranging flavor portfolio.

Manufactured in Lidkopen, Sweden since 1998, Svedka vodka is one of the best-selling imported vodkas in the U.S. Acquired by Constellation Brands in 2012, Svedka is known for its embrace of new technology to communicate with consumers and for its wide-ranging flavor portfolio.

“Our robust social and digital media channels allow us to have a direct dialogue with highly engaged consumers,” says VP of Spirits Carl Evans. “Our goal is to provide relevant and compelling content across all communication touchpoints to those in the know and on the go.”

More than 15% of the brand’s sales come from flavors, including its most recent launch Blue Raspberry, which was introduced in March. However, sales of the original Svedka remain strong.

“Mixology and the resurgence of classic and craft cocktails have put unflavored vodka front and center,” Evans says. “Innovative cocktails are no longer just for bars, with more and more consumers looking to recreate drinks during at-home occasions. This has benefited the performance of Svedka’s 80-proof business, which is at the core of our portfolio.”

On the Cusp for 2018 (14 Wins each):

On the Cusp for 2018 (14 Wins each):

Bacardi — Bacardi USA

Jose Cuervo — Proximo

Juarez Tequila — Luxco

Hall of Fame Entry Criteria

Each Hall of Famer must have earned its 15th Growth Brands Award in 2017, in any of the four categories (Rising Star, Fast Track, Established Growth or Comeback Brand). For the complete set of criteria, click here.

All sales data is compiled by Marina Velez of the Beverage Information & Insights Group. For more information about Growth Brands and other research products, please contact her at mvelez@epgmediallc.com.

Jeremy Nedelka is editor of Beverage Dynamics Magazine. Reach him at jnedelka@epgmediallc.com

The post 6 Spirits Join Our Growth Brands Hall of Fame first appeared on Beverage Dynamics.